Reducing Clinical Finished Goods Waste: An Industry Perspective

Table of content

Every year more than half of the clinical trial drugs manufactured never reach patients. These unused supplies, known as clinical finished goods (CFG), represent wasted medicine and wasted money. Since clinical trial supply typically accounts for 15% to 30% of total trial costs, high levels of CFG waste put significant pressure on both budgets and operations.

To better understand this challenge, Tenthpin conducted a first-of-its-kind benchmarking study with 7 major pharma companies. The goal was to:

- Establish a common measure of CFG waste and benchmark current results

- Identify what drives it

- Share the practices that can meaningfully reduce it

In this blog, we will show you the results of our study and what this means for Life Sciences companies across the industry.

How we benchmarked CFG waste performance

The industry standard definition for the CFG waste percentage calculation is:

The number of patient kit units which did not get dispensed to patients divided by the total number of manufactured (packaged) kits per the study.

This calculation captures expired kits during the study, as well as those on hand at the end of the study.

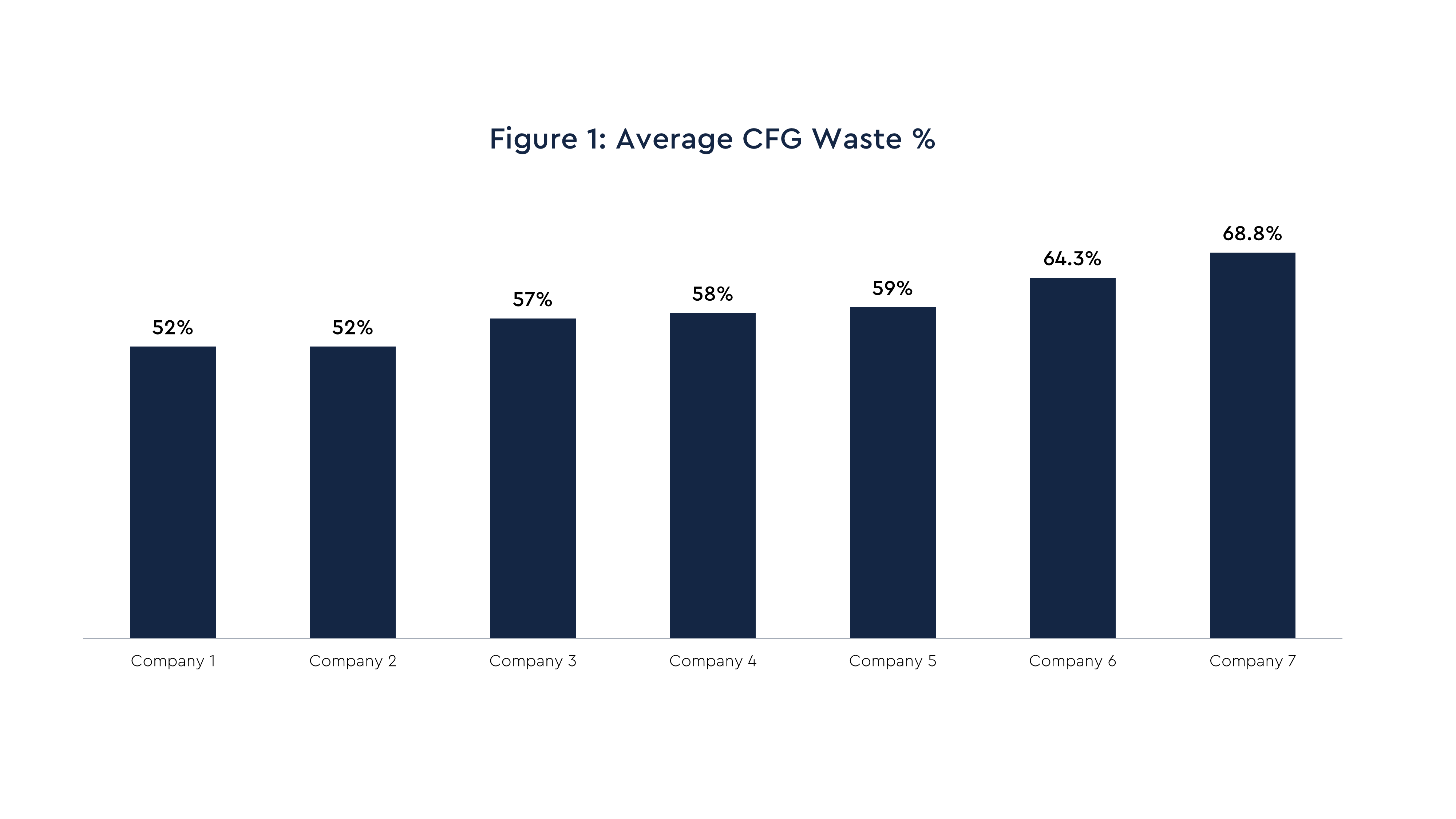

Using this standard, Figure 1 shows that the pharma company average percentage for CFG waste ranges from 52% to approximately 69%. It is important to note that for all the pharma companies, various efforts to reduce their CFG waste levels are in progress. This is happening primarily through tools and point solutions covering data analysis, management oversight, and planning capabilities.

The benchmarking effort also collected cost figures and more granular CFG waste level data across a range of categories including trial phase, drug type, and therapeutic area. This level of detail is valuable in pinpointing more specific opportunities for improving CFG waste performance.

What’s really driving CFG waste levels?

Clinical studies are known for their unpredictability. Patient enrollment rates and depot inventory stock levels often diverge significantly from initial study forecasts. In addition to this inherent unpredictability, numerous other variables can contribute to increased levels of CFG waste within a study.

The benchmark companies identified several root causes behind high waste, spanning both internal and external aspects of their clinical supply operations:

- Complex clinical study designs: These designs (e.g. complex titration schedules) can lead to increased demand variability and may require greater overage levels to ensure continuity of supply. Across the pharma companies, there is varying upfront inclusion of clinical supply considerations in the design of the study protocol.

- Changes in clinical study protocols: This factors in particularly during the patient enrollment period. These include study delays or accelerations, and country list adjustments.

- Compression of overall R&D timelines: The impact of timeframe compression is felt due to less time to plan and execute the clinical supply chain startup activities. Ultimately leading to faster, though less certain, supply decision making.

- Inaccurate patient enrollment forecasting: A growing portion of the pharma companies measure their patient enrollment forecast accuracy. Those that do typically see large variances versus the forecast.

- Conservative supply planning: The top priority is ensuring reliable drug supply at the clinical site. As a result, maintaining higher buffers on inventory levels remains the primary countermeasure, often due to a lack of visibility and enrolment predictability.

- Lengthy cycle times: Of particular impact is the time period between CFG packaging to the receipt of kits at the clinical site, as clinical drugs often have short shelf lives. .

Five CFG initiatives that are succeeding

With the benchmark companies underway with various efforts in technology, processes, and data integration to improve their CFG waste performance, some efforts have been working better than others. Below is a sample of these initiatives and successes:

- Select study ‘micro-management’: High priority (or high cost) studies are identified upfront by leadership. These studies are monitored more closely on a weekly basis for supply decisions and actions.

- Accuracy measures of the key demand signals: This includes measurement and improvements to the level of ‘inbound’ quality in the study’s finished goods demand signals.

- Employing specific tools for planning insights and predictions: Some pharma companies are making investments in analytical dashboards and AI tools. This is for improved patient enrollment models, predictive demand and supply modeling solutions, and analytic models; using combined data repositories across both depot and site inventory.

- Improvements to supply chain speed and agility: Examples include cycle time reductions of manufacturing planning to execution cycles, and the use of various supply pooling techniques.

- Increased collaboration between clinical supply and clinical operations groups: This includes alignment on the study design’s impacts on supply risk and costs, and improved communication of study protocol changes.

CFG waste targets and path forward to improvement

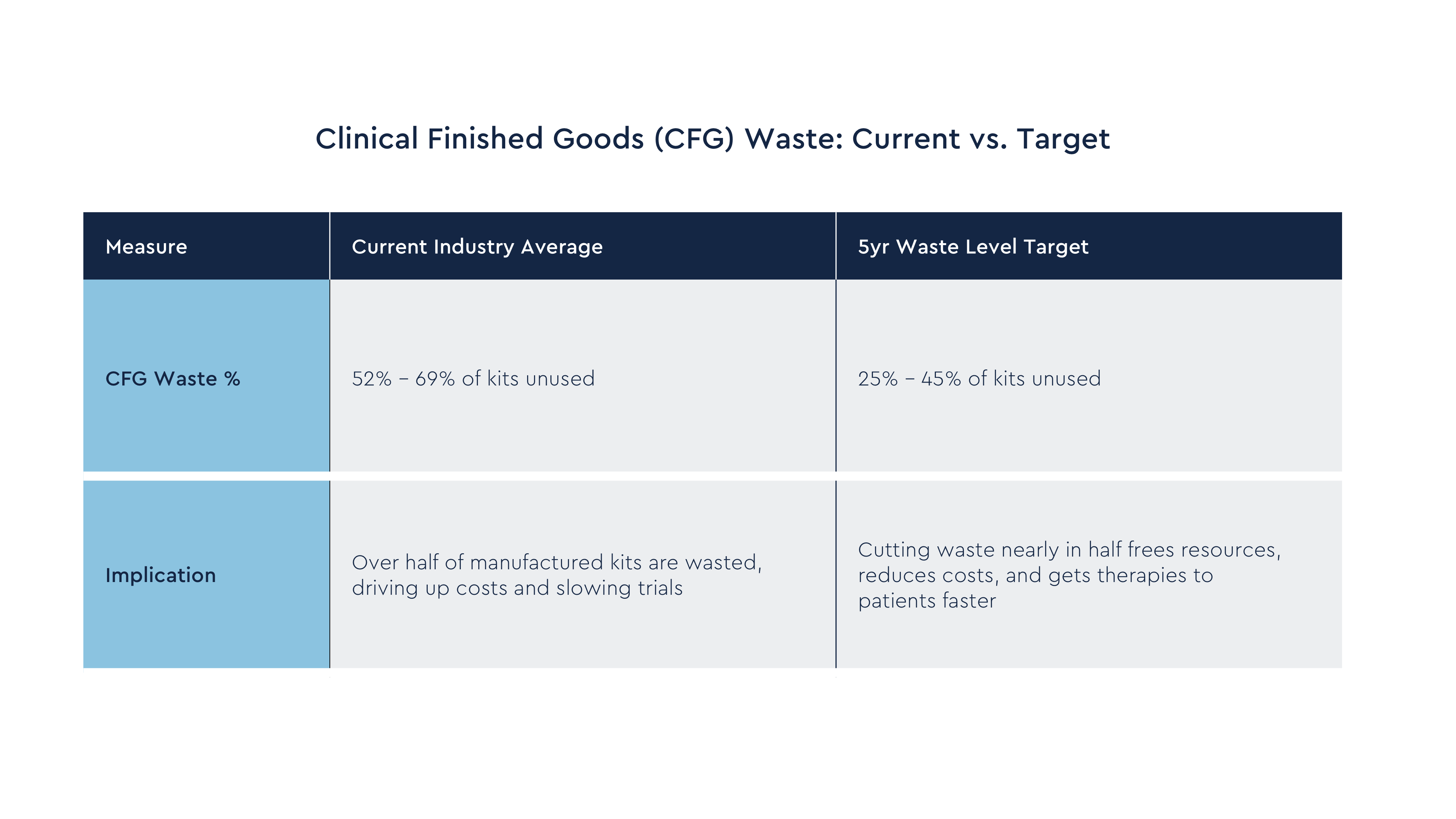

The average CFG waste percentage targets the pharma companies hope to achieve within the next 5 years range from 25% to 45%. This represents a significant improvement over the current levels of performance.

A few of the planned approaches from the pharma companies to achieving these CFG waste target levels are:

- Better systems, data and metrics: Improving their IT systems and 3rd party integrations to have better visibility of the full clinical trial supply chain enables better scenario planning and decision making. It also provides the ability to actively monitor CFG waste performance at category levels.

- Improved demand forecasting: These are improvements in data quality, demand signal accuracy, and robustness of modeling.

- Supply chain enhancements: These include supply pooling techniques, alternative clinical labeling approaches, decentralized inventory management to regional depots/distribution hubs, and adjusting clinical site buffer levels per actuals data.

- Frequent packaging runs: Having smaller, more frequent packaging runs has the effect of making patient kit supply production more demand driven.

- Advances and AI-driven tools: Examples here include leveraging AI tools for study enrollment predictive capabilities, using digital twin/scenario modeling, and automating expert oversight for demand and supply decision making.

Conclusion

The benchmark results show clearly: CFG waste levels are too high, and many existing efforts to reduce them have delivered mixed or unconfirmed results. But pharma companies are beginning to chart a path forward, and momentum for measurable improvement is building.

Success will require moving beyond isolated fixes to a structured, inclusive, and progressive journey anchored in the following four priorities:

One: Standardize reporting and metrics

Reliable, real-time CFG waste data (down to category and dollarized levels) is the foundation for identifying waste early and forecasting end-of-study outcomes.

Two: Sharpen demand signals

Patient enrollment forecast accuracy is the single most impactful driver of waste. Measuring its accuracy and tightening collaboration between clinical operations and clinical supply is essential.

Three: Adopt advanced supply chain techniques

Greater agility through smaller lot sizes, supply pooling, just-in-time labeling, and decentralized inventory management can reduce buffers without risking shortages.

Four: Leverage AI and analytics with a value lens

Further investments in predictive tools, digital twins, and scenario modeling should be tied directly to measurable improvements in waste performance.

Ultimately, cutting CFG waste is about more than efficiency. Every avoided wasted kit means more resources to invest in new therapies to clinical trial patients.

Looking for experts in clinical supply management?

Tenthpin’s Life Sciences consultants have a rich experience in designing and delivering clinical trials supply management solutions. See how we can help you, and why SAP Intelligent Clinical Supply Management is the answer to managing the seismic shift to patient-centric value chains.

INSIGHTS

Related insights

It’s been almost 20 years since data scientist Clive Humby made the proclamation that “Data is the new oil”. This could not be...

The shift to patient centricity, AI, and digital ecosystems is disrupting the Life Sciences industry. What was once a...

In the Life Sciences industry, where data integrity, regulatory compliance, and absolute accuracy are non-negotiable, SAP Master...