3 major trends disrupting the pharma industry and shaping the future of Supply Chain organisations.

As we work closely with clients in the pharmaceutical industry, we have identified three major trends that are playing a significant role in shaping the future of supply chains in the industry: specialization, reshoring, and virtualization. These trends have led to significant changes in the supply chains of pharmaceutical companies.

This article aims to explore the impact of these trends on the strategic perspectives and opportunities for supply chain organizations, including their processes and technology. We will also provide insights on how decision-makers can prepare for these changes and explain the benefits of supply chain segmentation in addressing these challenges. Additionally, we will discuss how organizations can embrace this approach and highlight the key role of technology in deploying it effectively within complex value chains.

1st trend is a deepening and ramification of market segmentation.

Segmentation as a tool for supply chain strategy setting has been around for a while. Core of the approach is enable companies to understand the strategic drivers behind their portfolio segmentation, help them focus on those segments and leverage on targeted competitive strengths and unique competences to be successful and thrive.

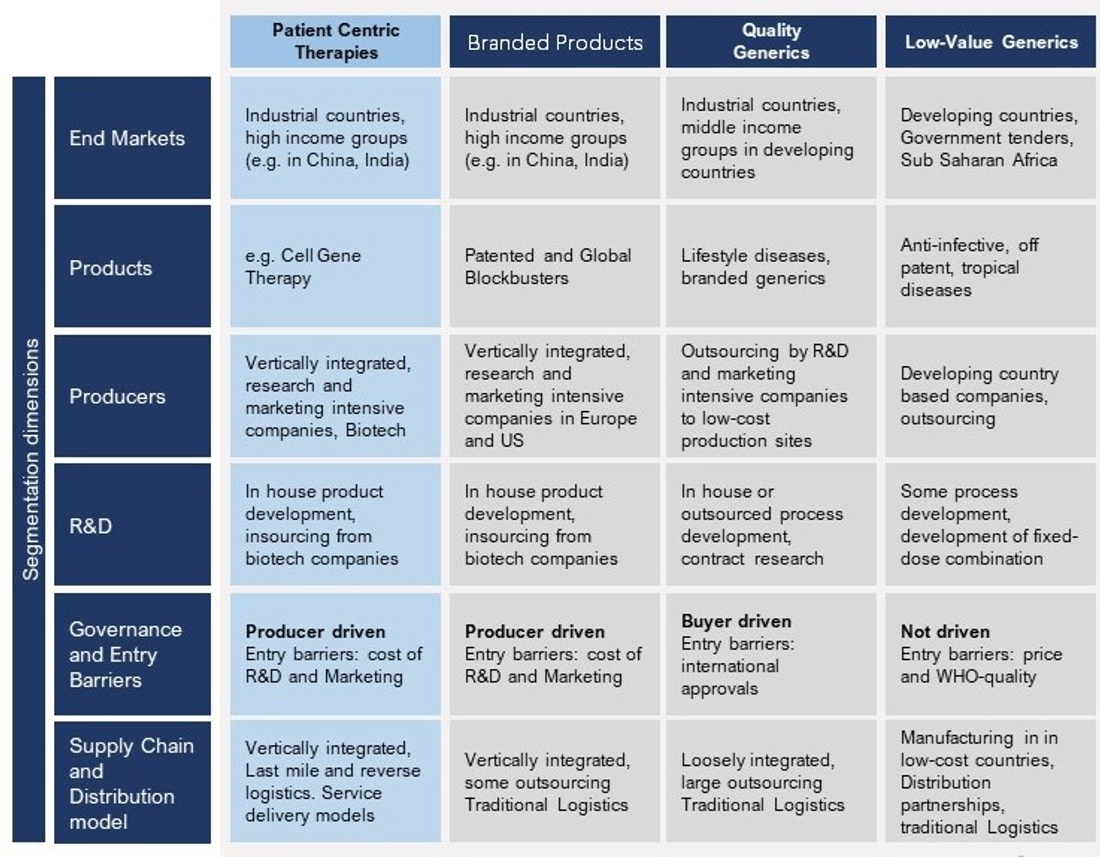

The following table provides a sample of segments classification and their key strategic features:

When at the end of the 90s countries with lower cost of labour developed the skills and industrial capabilities to produce generics and compete with the established pharm, cost base competition broke into the global market. First in local or underserved markets, then directly in developed countries.

In last 20 years, the companies successful in the cost sensitive segment further developed their capabilities and sharpened their approach towards the pursuit of approvals and regulatory compliance. As a consequence they have entered the value added quality generics segment, either in direct competition with established brands or partnering with developed regions producers as contract manufacturers, in both cases controlling most of the value chain of the drugs produced in the segment.

Finally, new segments emerge. From biotech big molecules to patient centric therapies, R&D powerhouses and small innovative firms in developed regions are delivering the first commercial products out of these innovative and promising pipelines.

These new segments require different manufacturing approaches, particularly in the final stages of the drug production and tailoring of the final prescription or single patient. Implications for the supply chain strategy are profound; from volume, efficiency oriented bulk processes to one-by-one, patient targeted drug and service delivery.

Take as example Cell & Gene Therapy, its supply chain is not anymore “Make to Stock” with a distribution chain from pallets to boxes to single packages and pills. There will be a combination of the classic “Make to Stock” for process components and an innovative last mile service chain, whereas the first act in the service provision is the collection of biological tissues from the patient to be timely delivered to a treatment centre, processed and delivered back to the patient for inoculation.

2nd trend: The next stage of (de-)globalisation

Great influence on the forces that shaped segmentation in pharmaceutical supply chain stemmed from the wider cross-industry trend of globalisation, in particular over the last 30 years.

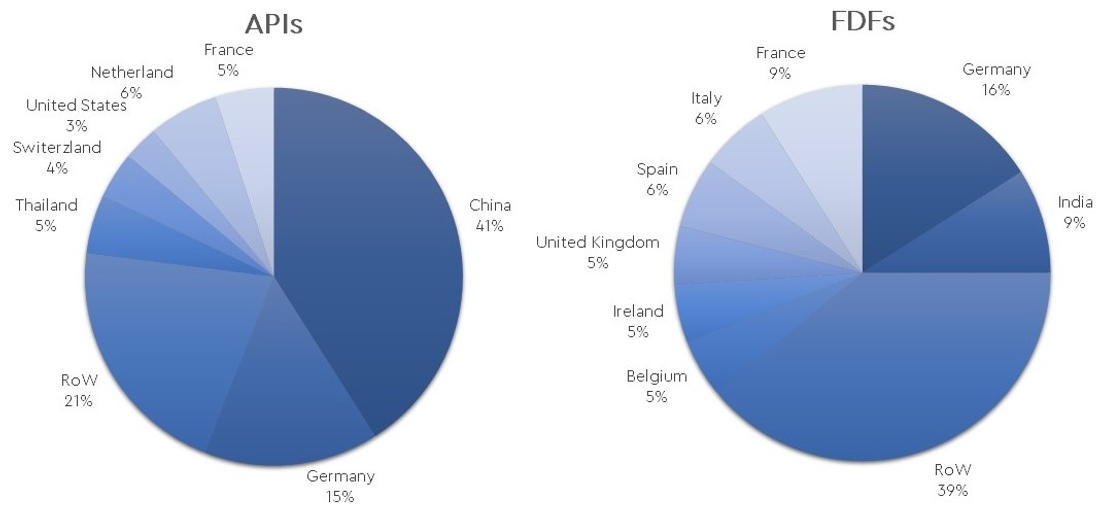

In the table below is the global distribution of drugs production.

Looking at the detail from a product perspective, while some drugs value chains maintain the core capacity in developed countries, for others the shift to quasi-monopoly in developing countries is a fact. The table shows examples of how supply sources are controlled for some well-known active principles.

Recently, the globalisation push has started to slow down, mostly due, among others, to two factors:

- National competitiveness concerns that trigger governments to implement industrial policies aiming to capture leading shares in emerging industries and markets.

- Self-sufficiency and national security concerns, highlighting the need for resilience and security of supply in various areas such as food, pharmaceuticals and medical equipment.

The pharmaceutical industrial footprint is therefore evolving, shifting the focus of sourcing strategy from reducing product cost reduction to increase resilience and shorten supply lanes. That does not revert globalisation back in time but generates three parallel sub trends:

- Reshoring, shorter and less fragmented GVCs, driven, for example, by increasing automation and protectionism in local markets.

- Regionalisation, shorter but fragmented GVCs, driven, for example, by sustainability considerations or sub-regional commercial integration.

- Replication, shorter and less fragmented ‘replicated’ GVCs, despite higher geographic distribution of activities, driven, for example, by distributed manufacturing strategies.

The 3rd trend is the virtualisation of Supply Chains planning and control.

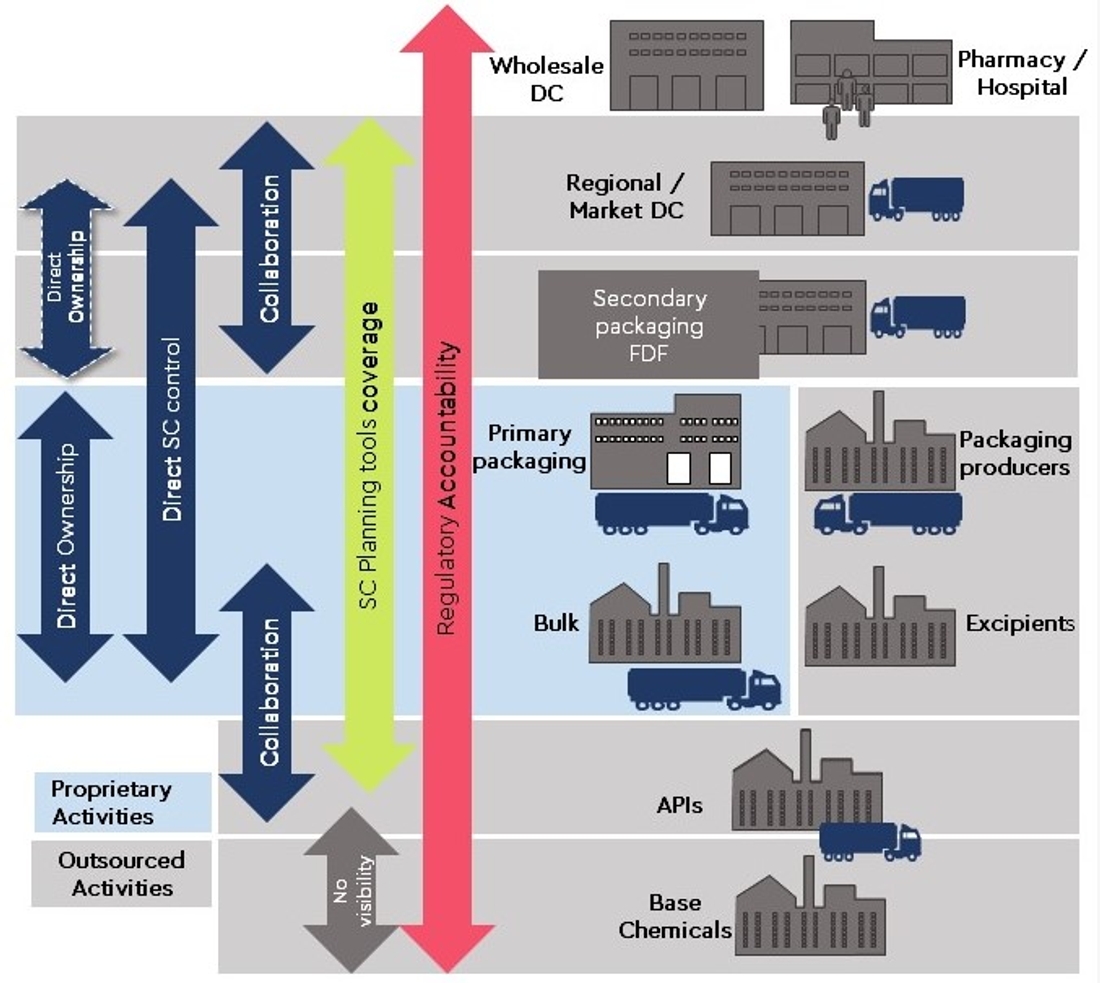

Companies have developed across the decades the processes and tools to allow them to plan and control the industrial footprint that they directly or indirectly own. While most companies have become pretty good at doing that, only few companies have also developed effective means to extend the planning and control scope beyond their organisational boundaries, with a remarkable cost while overcoming discouraging technological constraints.

This enhanced planning and control capability becomes a valuable competitive advantage when the combined effect of the two compelling forces hereafter puts supply chain strategists in front of the fait accompli of a supply chain virtualization:

- the ever increasing outsourcing of non-core business processes, to reduce production cost and leverage on partnerships with producers that have advantages of scale, cost or domain specific skills. Long and complex chains of subcontracting and contract manufacturing span across regions and across organisational entities.

- The accountability towards regulatory entities and the potential for reputational damage, whose scope extends beyond a company’s directly owned supply chain.

Supply Chain virtualisation pushes companies to develop their capability to plan and control quality across organisational layers in collaboration with partners. It exerts a game changing influence upon the shape of their organisation and the technology they deploy.

Two features of this shift in the planning strategy paradigm are particularly relevant. First, the new approaches might need not just an incremental improvement of the existing tools but rather an adoption of the latest generation of technologies. Secondly, also for planners more traditional training might not suffice and they will need to develop additional skillsets, both in quantitative disciplines and in soft partner collaboration techniques.

What are the implications of these incoercible trends for supply chain organisations and how is technology a key enabler, both evolutionary and disruptive, in the response to a changing competitive environment?

The impact on supply chain organizations: The monolithic approaches are usually not sufficient

How do we cope with these major trends and learn to build a strategically effective portfolio segmentation?

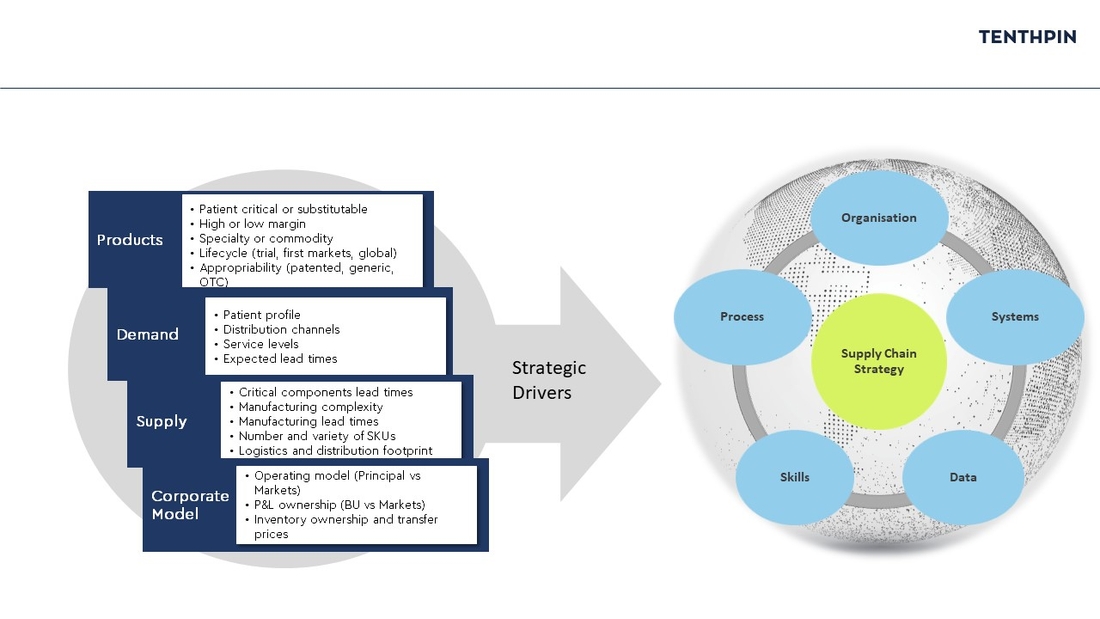

The first step is to explore and acknowledge the features competitive environment of the pharmaceutical company, not as a single entity but from the perspective of the segments that constitute its portfolio. Segmentation is a valuable exercise as much as it is focused and driven by quantitative analysis along some key dimensions: product, demand, supply, corporate model.

The image above is an example of the dimensions and features that might be worth considering within a segmentation analysis.

The result of the analysis informs the strategic drivers and from there each segment supply chain strategy and implementation pillars in terms of organisation, processes, systems, skills and data.

As expected, different segments will produce different combinations of strategic drivers. Therefore, they will require different supply chain strategies per segment and different, maybe conflicting, requirements for the implementation pillars.

One size does not fit all.

The outcomes of a portfolio segmentation might be hard to bring to a common organisational denominator and to a standard process template. Segmentation feeds the eternal conundrum between being purpose oriented and effective while efficient in the allocation of limited resources.

Here technology comes to rescue and its contribution is enhanced by the availability of the skill capable to run it, the data necessary to feed it and the development of an organisation that provides the behavioural incentives.

The key to optimise the trade-off is to build the supply chains around the portfolio segments while sharing to the largest extend the use of company assets, resources and tools.

This implies that the tools, as much as the organisations, must be flexible enough to embed and operate the different requirements into one coordinated modus operandi.

To bring some examples, the planning tool will be configured in different ways and with different functionalities depending on the segment, but all segments will share the same computational engine, integration architecture with partners and IT support and demand management.

The procurement organisation will segment the supplier base to cover for each segment specific needs, while it will be analysis and controlling the overall spend through combined analytics and consolidated tendering.

Similar examples can be made across manufacturing, logistics and sales.

Conclusion

The key learning is that before standardising processes, tools and organisation, aiming for efficiency, priority must be given to developing a clear strategic perspective and portfolio segmentation, as the key value driver of the whole supply chain.

In Tenthpin, we adopt the portfolio segmentation approach as the foundation for designing and blueprinting technology delivery across all value streams, in partnership with the main solution providers.

Stay up to date with the latest #Lifeattenthpin #LifeSciences #Pharma #MedDevices #Biotech #Digitalforlife #Thoughtleadership #Medical Technology #AnimalHealth news by following us on Instagram #LifeAtTenthpin Facebook Tenthpin and our Tenthpin LinkedIn corporate page.